Integration Details

Muse CheckBoost seamlessly integrates with RUN Powered by ADP®, using payroll data to support accurate tax withholding adjustments and compliance. The platform provides timely insights to help employers and employees better anticipate and manage tax obligations throughout the year. Guided recommendations and alerts help keep tax settings aligned as pay or life circumstances change. CheckBoost is continuously updated to reflect current tax regulations and is delivered through an intuitive interface that makes it easy to review and manage tax withholdings directly within payroll workflows.

ADP Applications Integrated

- RUN Powered by ADP®

Integration Type

- 1. Read data from ADP

2. Buy now

Application Type

- Data connector

Data Sync Frequency

- Real time

Data Fields

- The following fields will be read by Muse Tax Inc:

1. Employee’s Name

2. Year-to-Date Wages

3. Year-to-Date Taxes Withheld

4. Filing Status

5. Paycheck Date

6. Address

Customizable Tax Scenarios

Customizable Tax Scenarios help model how life events and changes—such as marriage, buying a home, or having a child—may impact tax withholdings and take-home pay. By previewing potential tax outcomes in advance, CheckBoost supports better planning, more accurate withholding decisions, and fewer surprises throughout the year.

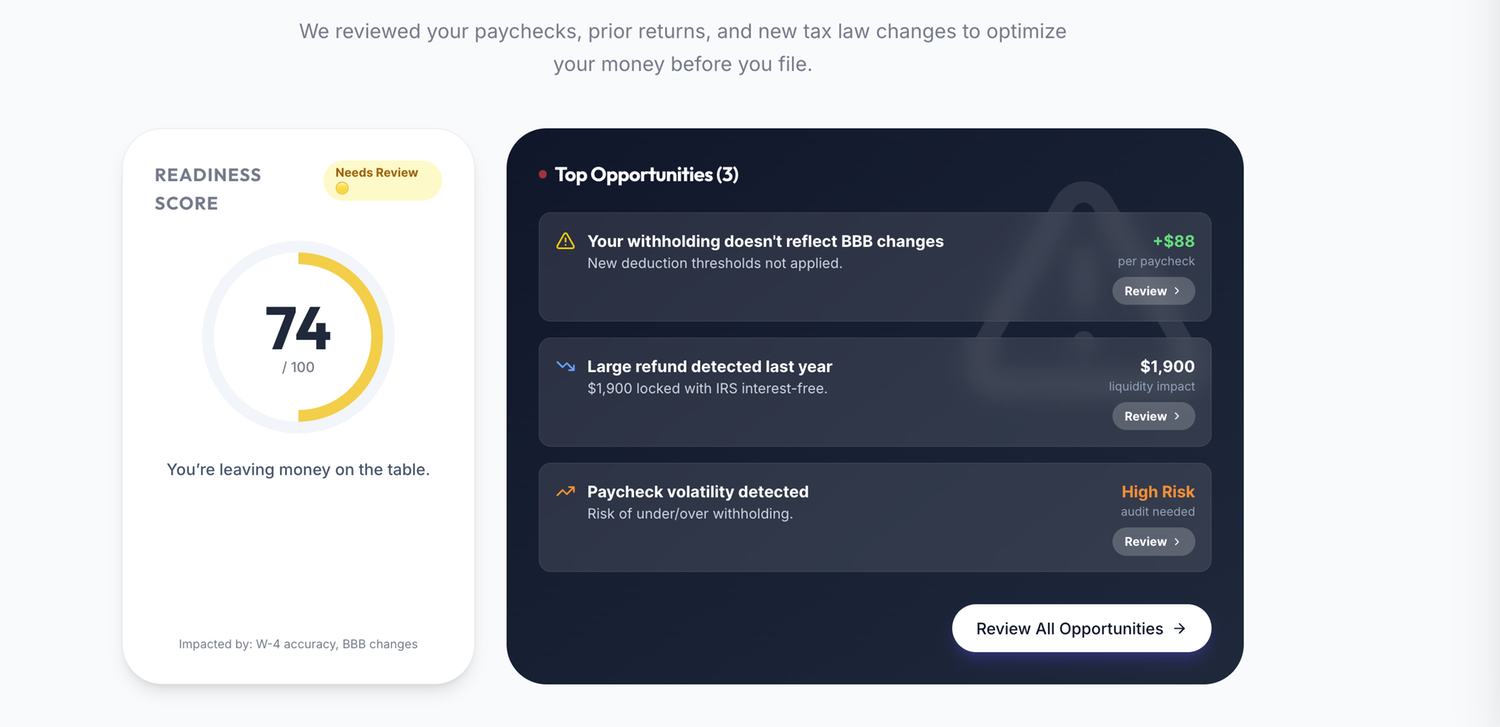

Refund Timing Optimization

Refund Timing Optimization is a feature of CheckBoost designed to help align tax withholdings more closely with actual tax liability. By improving withholding accuracy throughout the year, employees receive more of their earnings in regular paychecks rather than as a large year-end refund. This approach supports steadier cash flow, better financial planning, and improved financial flexibility without advancing wages or altering payroll processes.

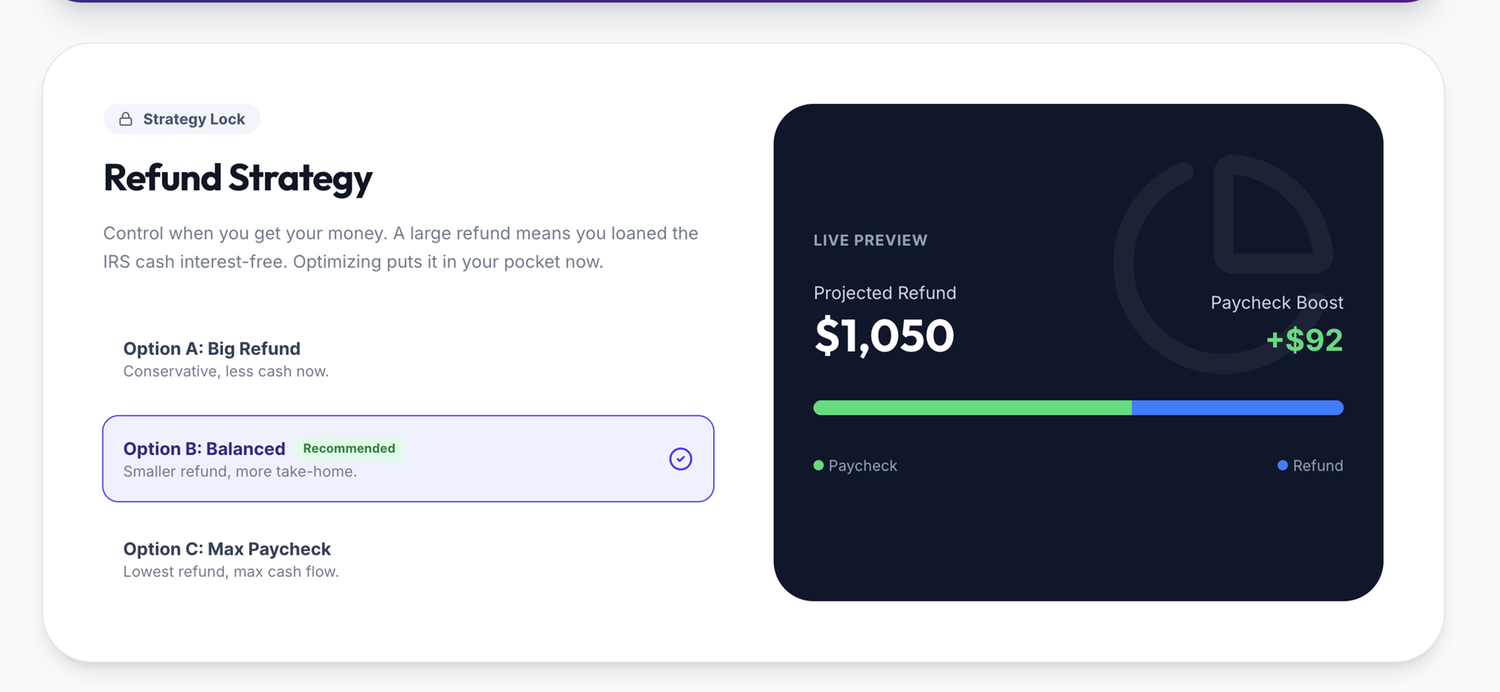

W-4 Optimization

Muse CheckBoost helps optimize employee tax withholdings by analyzing payroll and tax-relevant information such as pay, filing status, and deductions. Guided recommendations help keep withholdings aligned with actual tax liability, improving paycheck accuracy while supporting ongoing tax compliance.

Savings and Budgeting

CheckBoost™ supports budgeting and savings by helping employees achieve more predictable take-home pay through accurate tax withholdings. With steadier paychecks, employees can plan expenses more effectively and identify opportunities to improve savings, including the impact of tax-advantaged benefits—supporting better financial health across the organization.

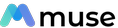

Real-Time Tax Monitoring

CheckBoost helps keep tax withholdings aligned as payroll and financial circumstances change throughout the year. Timely adjustments support more accurate tax payments, reduce surprises at filing time, and help employers and employees maintain predictable, compliant pay outcomes.