Integration with ADP

The Instant integration with ADP payroll systems, including RUN Powered by ADP® helps clients streamline operations and boost efficiency. The seamless connection automatically verifies employment and feature eligibility using existing payroll data—eliminating the need for any manual processes or added administrative burden. This ensures that pay information is transferred accurately and on time between platforms–reducing the risk of errors. The result? A hassle-free experience that delivers accurate, reliable pay access for every employee, every time

Earned Wage Access

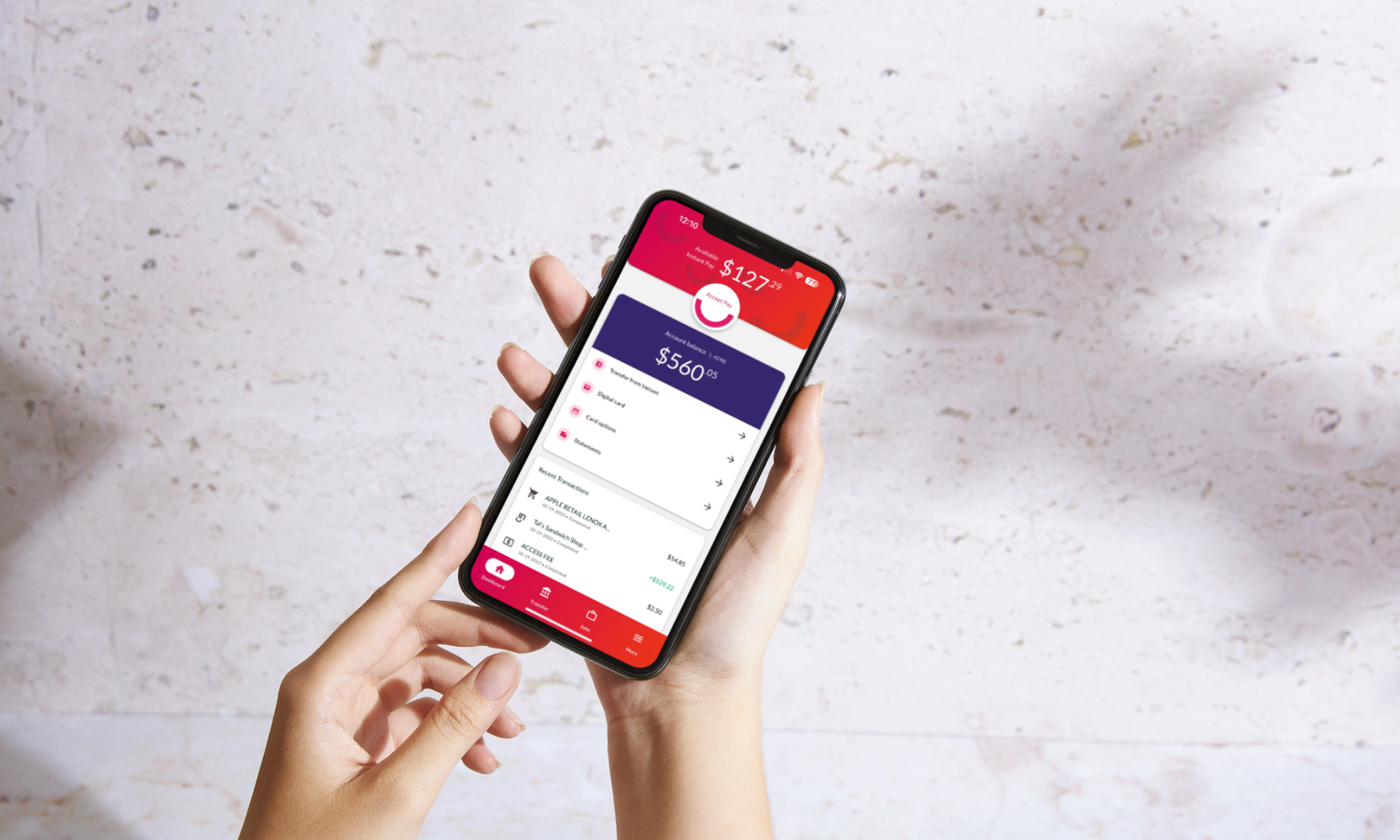

Instant Pay allows employees to access a portion of their daily earned pay before payday. Using the Instant app, an employee choses to accept the EWA offer, and funds immediately go to their Instant Visa® debit card that can be used to make purchases, withdraw cash from more than 40,000 surcharge-free ATMs, save for future or move to an existing bank account using regular or real-time transfer services. We're helping employees take control of their pay.

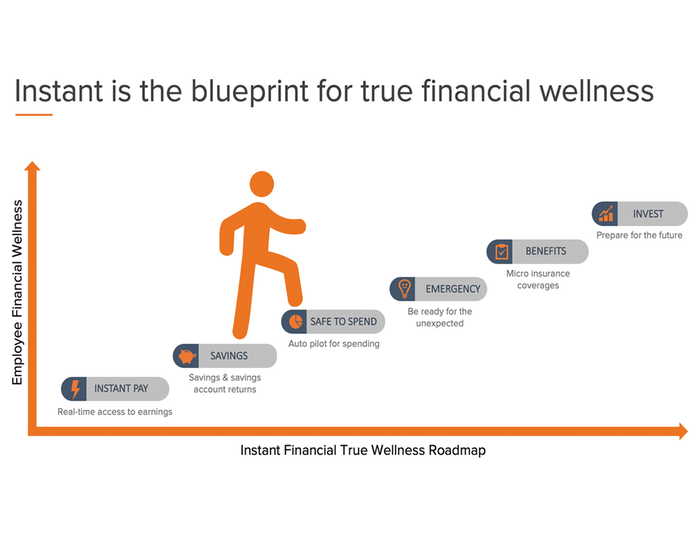

Instant Financial Wellness Platform

With 65% of Americans living paycheck to paycheck*, access to free or low cost financial wellness tools is an important benefit to help employees achieve financial independence. Instant has partnered with5 unique, best-in-class financial wellness product providers to offer tools that promote saving, build credit, and enhance financial health and well-being. *CNBC, Gill Malinsky: April 9, 2024 "More Americans say they are living paycheck to paycheck this year than in 2023—here’s why". www.cnbc.com/2024/04/09/most-of-americans-are-living-paycheck-to-paycheck-heres-why.html

Improved Engagement and Absenteeism

By offering the Instant Pay benefit, employers show that they care about their employees’ financial well-being because with flexible access to earnings, employees can improve their financial stability by being able to cover unexpected expenses, pay their bills on time, and avoid high-cost financing options like overdrafts, credit cards, and payday loans. As a result, employees are less stressed, more loyal and engaged at work. They tend to stay with the company longer and are motivated to pick up extra shifts knowing that they can get paid instantly.

No Bank Account Required

The Instant Pay benefit is available to all employees through the Instant Financial app and Instant Visa® debit card. There are no employee credit checks and qualifications required which means unbanked employees can access the program.

Instant Financial Provides Funding

Instant Financial provides funding at no cost to your company. There are no changes to the employer’s payroll processes. If employees accept their Instant Pay offers between pay cycles, they receive the rest of their pay on payday. Instant Financial is repaid by the employer for the early transfers made to employees on payday as well.

Simple and Compliant

Instant works alongside existing human capital management, payroll and time and attendance solutions. Instant is compliant with wage and hour laws in all 50 states.