Integration Details

Direct integration with the current version of RUN allows for employee data and hours data to flow directly into ACA Reporter to be used for ACA eligibility tracking, 1095 reporting, and IRS e-filing.

ADP Applications Integrated

- RUN Powered by ADP

Integration Type

- 1. Read data from RUN

2. Single Sign-On

3. Buy Now

Application Type

- Data Connector and End User

Data Sync Frequency

- 1. Real-time

2. Scheduled

Data Fields

- The following fields will be read by ACA Reporter:

•Employee Data

oFirst Name

oLast Name

oSocial Security Number

oEmployment Status

oLegal Address

oHourly Rate

oGender

oMarital Status

oOriginal Hire Date

oPhone Number

•Payroll Data

oPay Period Start Date

oPay Period End Date

oPaycheck Date

oGross Pay

oHours Worked

ADP Marketplace Partner Award Winner

Points North was named the 2022 Best Vertical Solution for crafting a vertically focused offering, driving relevant leads and successfully closing leads within that vertical.

ACA Dashboard

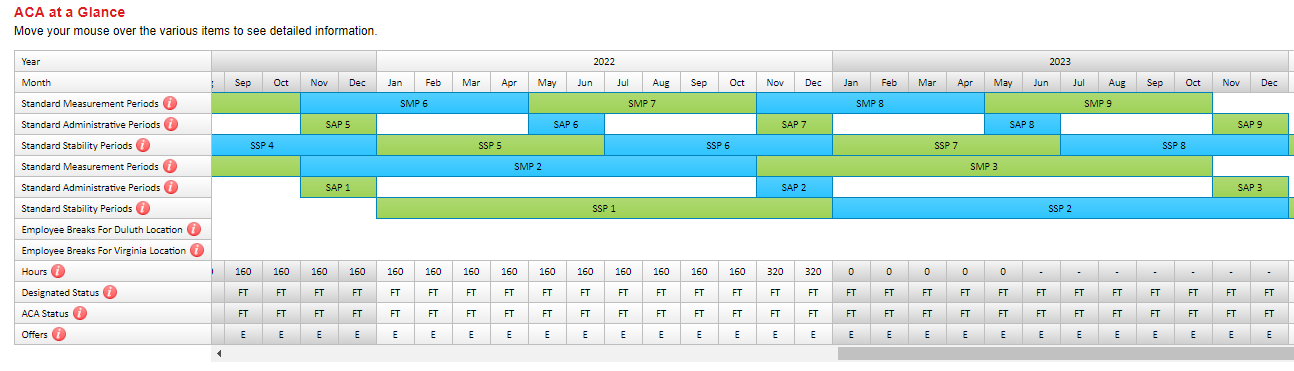

ACA Reporter provides a dynamic, comprehensive dashboard to display measurement method details, employee ACA eligibility status, offer of coverage data, and more.

Eligibility Tracking

ACA Reporter automatically tracks employee eligibility statuses based on IRS rules and regulations, and provides direct insight into which employees are approaching ACA full-time status based on configurable measurement methods.

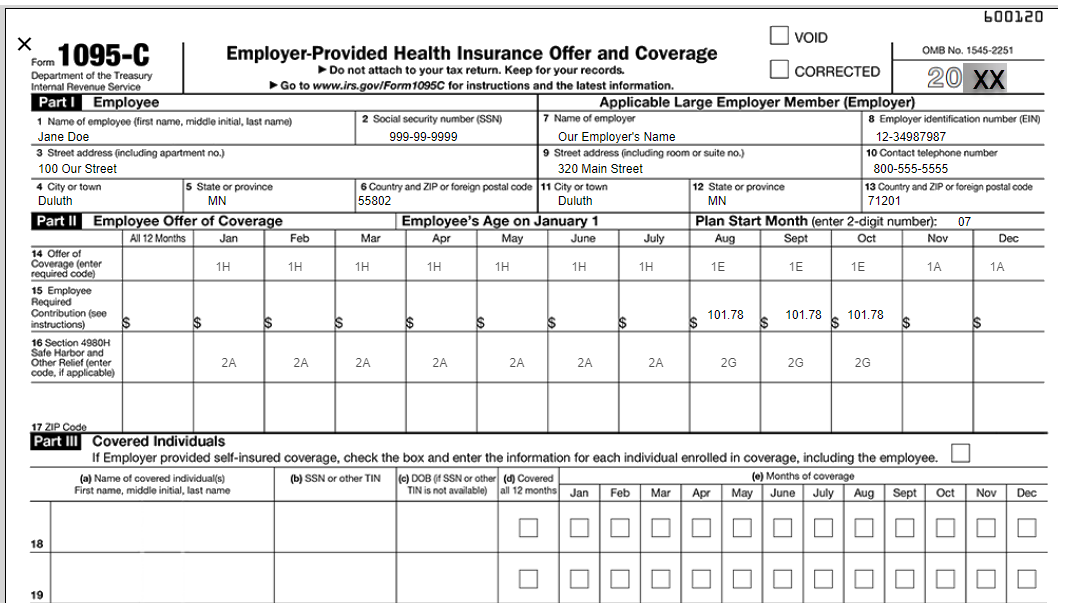

1095 Forms

Code combinations for 1095-C forms are automatically calculated based on employee data and enrollment information in ACA Reporter.

Form Fulfillment

Finalized 1095 forms can be printed and mailed directly to employees with the click of a button. Historical PDF copies of forms are always accessible in the system.

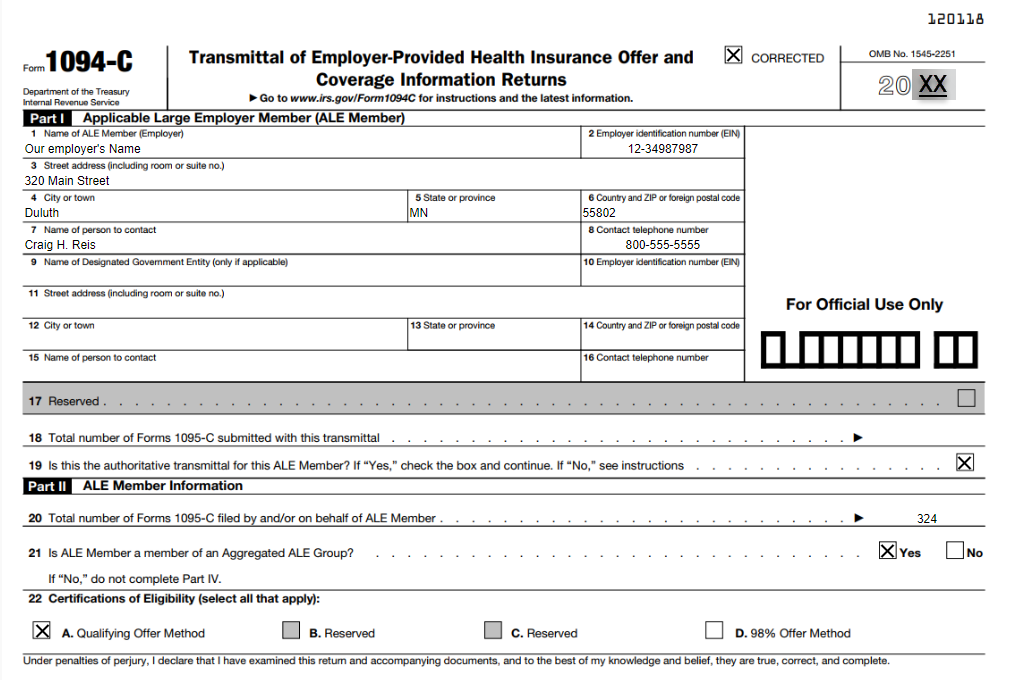

IRS E-filing

1095 and 1094 form data can be e-filed directly to the IRS from right within ACA Reporter. The status of your e-filing is displayed directly within the platform, as well as information regarding any errors that may need to be corrected.