Integration Details

Tapcheck’s simple, seamless, and free ADP Workforce Now® integration uses a daily, bi-directional data exchange that requires minimal incremental work on your end. So let’s start spreading financial empowerment and peace of mind to your employees today!

Applications Integrated

- ADP Workforce Now® (current version)

ADP TotalSource®

Application Type

- 1. Bi-directional data exchange

2. Single Sign-On (Practitioner only)

3. Buy Now

Integration Type

- Data Connector

Data Sync Frequency

- Daily Scheduled

Data Fields

- The following fields will be sent from Tapcheck to ADP Workforce Now®

- Timesheet from ADP Time and Attendance

- Employee ID, First Name, Last Name, Hours, Deduction Amount, Deduction Code, Taxes, Deductions, Pay Rate, Termination Date, Hire Date, Employment Status, Shift Data

- The following fields will be read by Tapcheck:

Employer Activation:

- 1. Meet with the Tapcheck onboarding team to initiate activation of the connector for ADP Workforce Now® for your business and integration with your time and attendance system.

2. Activate the integration for the ADP or third-party time and labor management system used to track completed employee shifts.

3. Once configured, launch and announce the availability of the platform to your employees in collaboration with your Account Manager.

4. Your dedicated Account Manager works with you every step of the way, from initial call through successful launch, providing you with all of the materials needed to drive awareness of your new benefit to employees.

Employee Registration & Experience:

- 1. Verify identity and employment with your company.

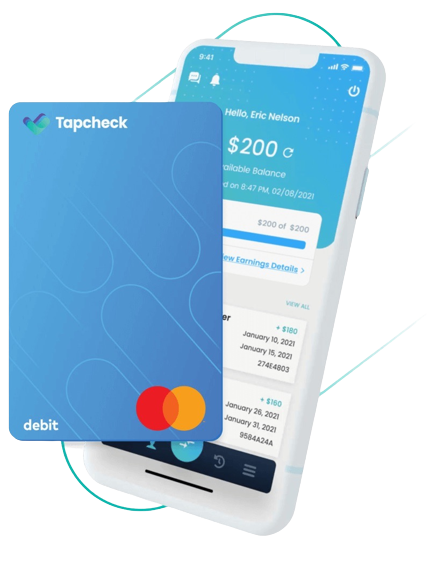

2. Designate a bank account for wage withdrawals or sign up for an optional Tapcheck Mastercard.

3. Complete shifts, clocking in and out as instructed by your company. Tapcheck will automatically recalculate and update the withdrawal balance.

4. Open Tapcheck to view available balance and make withdrawals as needed.

5. On payday, any funds withdrawn early through Tapcheck are recovered via a deduction shown on the paystub and in the Tapcheck app.

New and tenured employees alike can access their earned wages through Tapcheck shortly after registration, contributing to higher overall employee adoption rates. Since new employees tend to be most at risk for turnover, it’s especially important to enable immediate access to the benefit on day one.

High Precision Earned Wage Access Payouts

What sets Tapcheck apart from other solutions is that we use more data from ADP Workforce Now® and over 100 third-party time and labor management systems with which we integrate. This allows us to provide improved balance availability, higher withdrawal amounts, lower probability of overdraft, and equal accessibility for new and tenured employees. With our precise EWA calculations, employees can take larger withdrawals for the same flat transfer fee, equating to lower effective fees versus other platforms.* This gives a simple, reliable, and user-friendly experience for employers and employees alike and drives the highest employee adoption and business impact. *Relevant only when EWA transfers fees apply; not applicable to free transfers.

Payroll-based Recovery

The total amount an employee transfers in a pay period will be automatically deducted from their next paycheck via a payroll-based deduction. Employees can see this deduction on their pay stub and in the Tapcheck app, while employers can view it in ADP's payroll register and the Tapcheck admin dashboard. This creates a clear reconciliation process compared to other solutions that recover funds outside of payroll, which often creates confusion and perceived inaccuracies for both employees and employers.

Disburse Money Outside of Normal Pay Cycles

Tapcheck offers a simple, quick, flexible, and cost-effective way for employers to disburse payments to employees outside of normal pay cycles. The most common examples of disbursements are final paychecks, spot bonuses, tips, and payroll corrections. With Tapcheck’s payment Disbursements feature, employers can:

- 1. Make instant and secure payments to employees.

2. Eliminate the hassle and high cost of traditional payment methods such as paper checks, cash, or bank transfers.

3. Ensure payment accuracy and reliability.

4. Improve the overall payment experience for employees.

Tapcheck Mastercard® Payroll Card Options

Our optional Tapcheck Mastercards are designed to meet the needs of underserved employees, providing them with a reliable payment solution and free alternative to the traditional banking system. Tapcheck Mastercards can be issued to employees before they show up in payroll, allowing for quick enablement of direct deposits during employee onboarding. You can request a stack of payroll cards to hand out to any employee during onboarding, or your employees (18 years of age or older) can easily apply online for our advanced card that they can load cash to themselves —no credit checks, overdraft fees, or bank account required!

- With the Tapcheck Mastercards, your employees can get their full paycheck up to 2 days early* at no cost when they set up direct deposits. They’ll also have the ability to:

1. Send EWA transfers** directly to their card

2. Take fee-free ATM withdrawals with MoneyPass

3. Add their card to popular digital wallets

4. Make in-store and online purchases

5. Load cash directly to their card via Mastercard’s rePower network

- * Many, but not all, employers, government benefits providers, and other originators send direct deposits early with an effective date of 1-2 days later. Beginning with your second direct deposit of at least $5 from the same source, Central Bank of Kansas City (CBKC) will post the funds to your Tapcheck Card when we receive it, rather than on the effective date. This may result in your having access to the funds sooner. The date CBKC receives your direct deposit and the effective date are controlled by the originator.

- ** Central Bank of Kansas City does not administer nor is liable for earned wage access draws. The Tapcheck Mastercard is issued by Central Bank of Kansas City, Member FDIC, pursuant to a license from Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and Fee Schedule. If you have any questions regarding the Card or such fees, terms, and conditions, you can contact us toll-free at 1-844-404-0389, 24 hours a day, 7 days a week, 365 days a year.

Employee’s Choice in Payout Account

Tapcheck has a flexible and employee-centric payout system, where we prioritize individual preferences and do not force the use of a specific payout account. Employees can choose to send their direct deposits and EWA transfers to their:

- Bank account

- Tapcheck Mastercard

- Third-party debit card

Financial Wellness Tools

Financially healthy employees help strengthen your company’s bottom line. That’s why it’s our top priority to provide the financial education and wellness tools your employees need to reduce money stress and gain financial control. Using our free resources, employees can learn more effective ways to budget, save, and increase their credit score.

Security and Privacy

Tapcheck is SOC 2 compliant and adopts appropriate data collection, storage and processing practices, encryption, and other security measures to protect your sensitive information transmitted both online and offline. The computers/servers on which we store personally identifiable information are kept in a secure environment.

ADP Marketplace Platinum Partner

Tapcheck has achieved the highest recognition as an ADP Marketplace Platinum Partner, providing Earned Wage Access and Financial Wellness solutions tailored for midsize and enterprise businesses. We are committed to making a difference in the lives of our customers through our exceptional technology and customer service.